Secure the funds you need with flexible Bridging Loans

Property Purchases: For acquisitions, auctions, or raising funds

Renovations & Construction: Provides financial backing for project

Chain Resolution: Supports when property chains face delays.

Meet your advisor

Akhil Mair

Available for work

Akhil Mair

Available for work

Akhil Mair

Available for work

1

Expert Knowledge: Years of experience in mortgage advising

2

Wide Lender Network: Access to over 135 trusted lenders

3

Personalised Service: Tailored advice to meet your unique needs

4

Customer Satisfaction: Committed to clear, responsive communication throughout

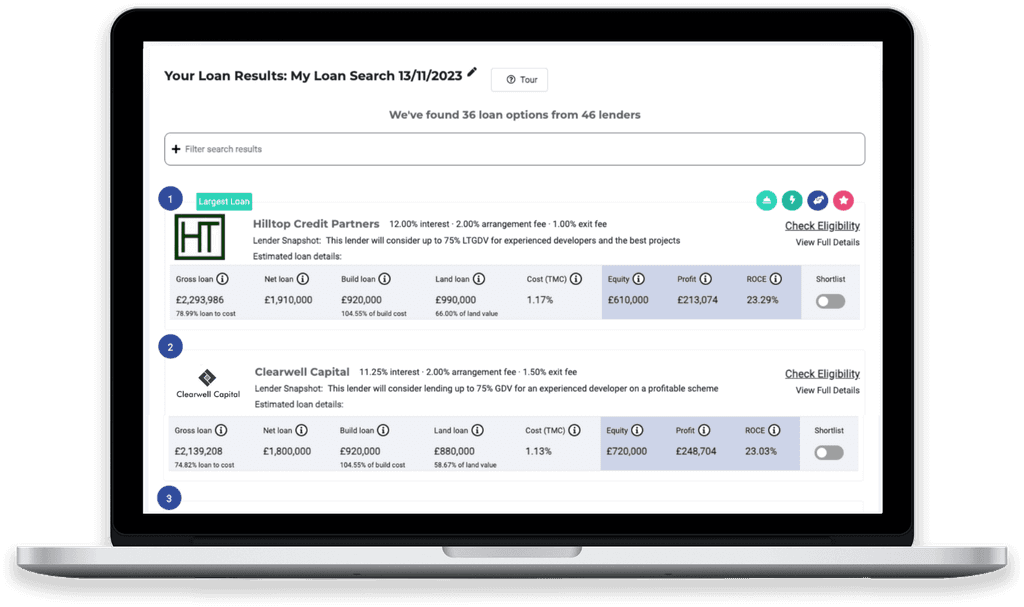

We Compare loans from 135+ lenders

We Compare loans from 135+ lenders

GET STARTED

What are you looking for today?

Bridging Finance

Planning Bridge

Purchase / Refinance

Refurbishment

Developer Exit

Commercial Mortgages

Commercial Term Finance

Owner Occupied

HMO's

Multi-Unit Freehold Blocks

Development Finance

New Builds

Permitted Developments

Conversions

Detailed Planning in place

We Compare loans from 135+ lenders

We Compare loans from 135+ lenders

With access to over 135 lenders, we find the perfect loan solution for you—quickly, efficiently, and with your goals in mind.

With access to over 135 lenders, we find the perfect loan solution for you—quickly, efficiently, and with your goals in mind.

CONTACT US

Your Questions, Our Expertise – Get in Touch

FAQs

Explore all the details about bridging loans and how they work below.

What is a bridging loan?

A bridging loan is a short-term financial solution designed to “bridge the gap” between the purchase of a new property and the availability of long-term financing, such as a mortgage, or the sale of another property.

How long can I take out a bridging loan for?

Bridging loans are typically available for terms of 1 to 12 months for regulated loans and up to 24 months for non-regulated loans. The exact term depends on your needs and exit strategy.

What is an exit strategy, and why do I need one?

An exit strategy is the plan for repaying your bridging loan, which could involve selling a property, refinancing, or using other funds. Lenders require this to ensure you can repay the loan at the end of the term.

How much deposit do I need for a bridging loan?

The deposit usually ranges from 10% to 40% of the property’s value, depending on the loan type, property condition, and any planned renovations.

Are bridging loans more expensive than mortgages?

Yes, bridging loans typically carry higher interest rates due to their short-term nature and the associated risks. Monthly rates range from 0.5% to 1.5%, which is higher than traditional mortgages.

Can I get a bridging loan if I have bad credit?

It is possible to secure a bridging loan with bad credit, though the interest rates and deposit requirements may be higher. Lenders are more focused on the value of the security property and the exit strategy.

Still got questions?

If you don't find an answer to your question, contact us, and our team will get in touch with you.

FAQs

Explore all the details about bridging loans and how they work below.

What is a bridging loan?

A bridging loan is a short-term financial solution designed to “bridge the gap” between the purchase of a new property and the availability of long-term financing, such as a mortgage, or the sale of another property.

How long can I take out a bridging loan for?

Bridging loans are typically available for terms of 1 to 12 months for regulated loans and up to 24 months for non-regulated loans. The exact term depends on your needs and exit strategy.

What is an exit strategy, and why do I need one?

An exit strategy is the plan for repaying your bridging loan, which could involve selling a property, refinancing, or using other funds. Lenders require this to ensure you can repay the loan at the end of the term.

How much deposit do I need for a bridging loan?

The deposit usually ranges from 10% to 40% of the property’s value, depending on the loan type, property condition, and any planned renovations.

Are bridging loans more expensive than mortgages?

Yes, bridging loans typically carry higher interest rates due to their short-term nature and the associated risks. Monthly rates range from 0.5% to 1.5%, which is higher than traditional mortgages.

Can I get a bridging loan if I have bad credit?

It is possible to secure a bridging loan with bad credit, though the interest rates and deposit requirements may be higher. Lenders are more focused on the value of the security property and the exit strategy.

Still got questions?

If you don't find an answer to your question, contact us, and our team will get in touch with you.

FAQs

Explore all the details about bridging loans and how they work below.

What is a bridging loan?

A bridging loan is a short-term financial solution designed to “bridge the gap” between the purchase of a new property and the availability of long-term financing, such as a mortgage, or the sale of another property.

How long can I take out a bridging loan for?

Bridging loans are typically available for terms of 1 to 12 months for regulated loans and up to 24 months for non-regulated loans. The exact term depends on your needs and exit strategy.

What is an exit strategy, and why do I need one?

An exit strategy is the plan for repaying your bridging loan, which could involve selling a property, refinancing, or using other funds. Lenders require this to ensure you can repay the loan at the end of the term.

How much deposit do I need for a bridging loan?

The deposit usually ranges from 10% to 40% of the property’s value, depending on the loan type, property condition, and any planned renovations.

Are bridging loans more expensive than mortgages?

Yes, bridging loans typically carry higher interest rates due to their short-term nature and the associated risks. Monthly rates range from 0.5% to 1.5%, which is higher than traditional mortgages.

Can I get a bridging loan if I have bad credit?

It is possible to secure a bridging loan with bad credit, though the interest rates and deposit requirements may be higher. Lenders are more focused on the value of the security property and the exit strategy.

Still got questions?

If you don't find an answer to your question, contact us, and our team will get in touch with you.

Contact Us

Our Mortgage Broker Limted

23 Berkeley Square

Mayfair

London

W1J 6HE

0203 971 1234

info@ourmortgagebroker.co.uk

Our Mortgage Broker Limited

Our Mortgage Broker Limited, 23 Berkeley Square, Mayfair, London W1J 6HE

Our Mortgage Broker Limited is authorised and regulated by the Financial Conduct Authority. Our FCA number is 944663 and this can be checked by visiting www.fca.org.uk/register Our Mortgage Broker Limited is registered in England and Wales, registration number 11358646.

Contact Us

Our Mortgage Broker Limted

23 Berkeley Square

Mayfair

London

W1J 6HE

0203 971 1234

info@ourmortgagebroker.co.uk

Our Mortgage Broker Limited

Our Mortgage Broker Limited, 23 Berkeley Square, Mayfair, London W1J 6HE

Our Mortgage Broker Limited is authorised and regulated by the Financial Conduct Authority. Our FCA number is 944663 and this can be checked by visiting www.fca.org.uk/register Our Mortgage Broker Limited is registered in England and Wales, registration number 11358646.

Contact Us

Our Mortgage Broker Limted

23 Berkeley Square

Mayfair

London

W1J 6HE

0203 971 1234

info@ourmortgagebroker.co.uk

Our Mortgage Broker Limited

Our Mortgage Broker Limited, 23 Berkeley Square, Mayfair, London W1J 6HE

Our Mortgage Broker Limited is authorised and regulated by the Financial Conduct Authority. Our FCA number is 944663 and this can be checked by visiting www.fca.org.uk/register Our Mortgage Broker Limited is registered in England and Wales, registration number 11358646.